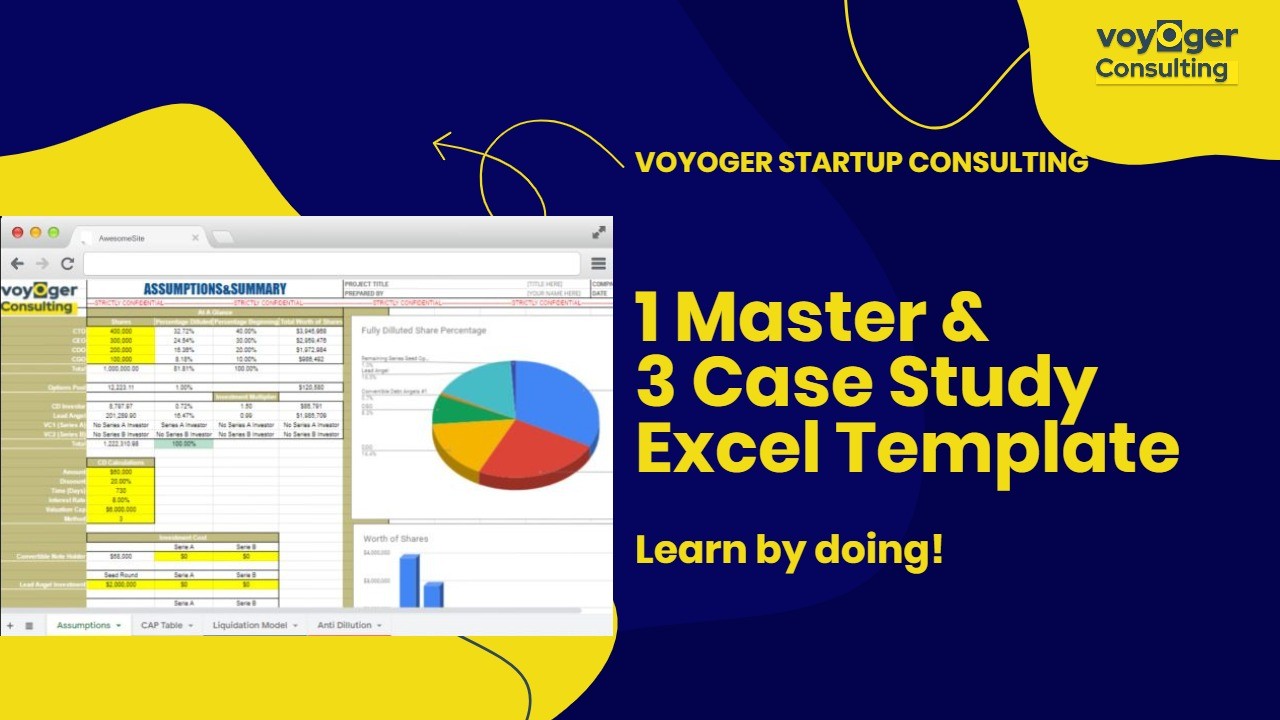

Have you ever thought about how much equity should you offer in exchange for an investment? Do you understand the mechanics of startup investment fully? For the last 6 years of consulting startup founders and investors, the most common question I came across was about equity and convertible note conversions. To calculate the equity dilution of founders and also converting shares for investors depends on a couple of conditions such as company valuation, convertible note clauses, and agreements with further investors. With this Excel template and eBook, you will be able to analyze your dilution and moreover, you can use your analysis of your negotiations as leverage. Learn the meaning of SAFE clauses and avoid future errors in your deals. Understand startup investment better. Save money on consultants to prepare CAP Table. Know what you are doing when negotiating and learn Convertible Note / SAFE clauses meanings. Access our CAP Table Analysis Excel Template, three case study templates, and startup investment eBook today!

Overview

Deal terms & conditions

Digital download of Startup Investment & Modelling with Excel

- This deal is non-refundable

Get lifetime access. Just download and save within 60 days of purchase.